Variable Costs Number Of Units Sold . Variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is. Variable costs = total cost of materials + total cost of labor. Variable cost per unit refers to the incremental cost associated with producing one additional unit of a product or. When production or sales increase, variable costs increase; A variable cost is an expense that changes in proportion to production output or sales. That unit could be a. Variable cost per unit explained. Total costs = fixed costs + variable costs. Total variable cost = (total quantity of output) x (variable cost per unit of output) cost of. The formula can be represented in 2 ways: A variable cost is the price of raw materials, labor, and distribution associated with each unit of product or service you sell. Alternatively, a company’s variable costs can also be. The formula for total variable cost is:

from efinancemanagement.com

The formula for total variable cost is: A variable cost is an expense that changes in proportion to production output or sales. Variable costs = total cost of materials + total cost of labor. Alternatively, a company’s variable costs can also be. When production or sales increase, variable costs increase; The formula can be represented in 2 ways: Variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is. Total costs = fixed costs + variable costs. Variable cost per unit explained. Variable cost per unit refers to the incremental cost associated with producing one additional unit of a product or.

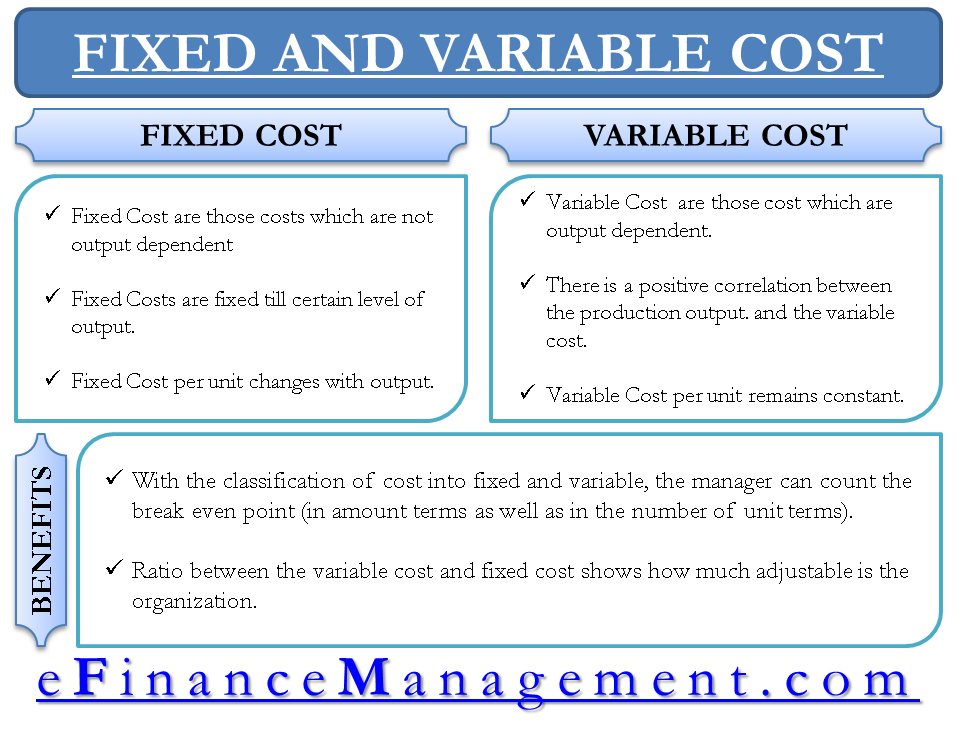

Variable Costs and Fixed Costs

Variable Costs Number Of Units Sold When production or sales increase, variable costs increase; The formula can be represented in 2 ways: A variable cost is the price of raw materials, labor, and distribution associated with each unit of product or service you sell. The formula for total variable cost is: Variable costs = total cost of materials + total cost of labor. Variable cost per unit explained. That unit could be a. Variable cost per unit refers to the incremental cost associated with producing one additional unit of a product or. Variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is. A variable cost is an expense that changes in proportion to production output or sales. Total costs = fixed costs + variable costs. When production or sales increase, variable costs increase; Total variable cost = (total quantity of output) x (variable cost per unit of output) cost of. Alternatively, a company’s variable costs can also be.

From courses.lumenlearning.com

Using Variable Costing to Make Decisions Accounting for Managers Variable Costs Number Of Units Sold Variable cost per unit explained. Variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is. Variable costs = total cost of materials + total cost of labor. Total variable cost = (total quantity of output) x (variable cost per unit of output) cost of. When production or sales increase, variable costs increase;. Variable Costs Number Of Units Sold.

From tutorstips.com

Difference between Fixed Cost and Variable Cost Tutor's Tips Variable Costs Number Of Units Sold Variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is. Variable cost per unit explained. A variable cost is an expense that changes in proportion to production output or sales. Alternatively, a company’s variable costs can also be. Total variable cost = (total quantity of output) x (variable cost per unit of. Variable Costs Number Of Units Sold.

From www.coursehero.com

[Solved] Statements under Absorption Costing and Variable Variable Costs Number Of Units Sold Variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is. Total costs = fixed costs + variable costs. Variable cost per unit refers to the incremental cost associated with producing one additional unit of a product or. Variable cost per unit explained. The formula for total variable cost is: A variable cost. Variable Costs Number Of Units Sold.

From www.bartleby.com

Answered Home Insert Page Layout Formulas Data 1… bartleby Variable Costs Number Of Units Sold Variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is. A variable cost is the price of raw materials, labor, and distribution associated with each unit of product or service you sell. Variable cost per unit explained. Variable cost per unit refers to the incremental cost associated with producing one additional unit. Variable Costs Number Of Units Sold.

From www.chegg.com

Solved In each of the cases below, assume that Division X Variable Costs Number Of Units Sold Variable cost per unit refers to the incremental cost associated with producing one additional unit of a product or. Alternatively, a company’s variable costs can also be. Variable costs = total cost of materials + total cost of labor. That unit could be a. Total costs = fixed costs + variable costs. Total variable cost = (total quantity of output). Variable Costs Number Of Units Sold.

From www.chegg.com

Solved ABC Company’s actual unit sales in the current year Variable Costs Number Of Units Sold When production or sales increase, variable costs increase; Total variable cost = (total quantity of output) x (variable cost per unit of output) cost of. Variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is. Total costs = fixed costs + variable costs. A variable cost is an expense that changes in. Variable Costs Number Of Units Sold.

From www.chegg.com

Solved Sales Variable and Absorption Costing Grant Company Variable Costs Number Of Units Sold Variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is. Variable cost per unit refers to the incremental cost associated with producing one additional unit of a product or. The formula can be represented in 2 ways: Variable cost per unit explained. Variable costs = total cost of materials + total cost. Variable Costs Number Of Units Sold.

From www.chegg.com

Solved Martinez Company's relevant range of production is Variable Costs Number Of Units Sold That unit could be a. Alternatively, a company’s variable costs can also be. Total costs = fixed costs + variable costs. The formula for total variable cost is: A variable cost is the price of raw materials, labor, and distribution associated with each unit of product or service you sell. Variable costing is a concept used in managerial and cost. Variable Costs Number Of Units Sold.

From www.bartleby.com

Answered Chapter 6 Variable Costing and Analysis… bartleby Variable Costs Number Of Units Sold Total costs = fixed costs + variable costs. Alternatively, a company’s variable costs can also be. The formula for total variable cost is: Variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is. A variable cost is the price of raw materials, labor, and distribution associated with each unit of product or. Variable Costs Number Of Units Sold.

From www.transtutors.com

(Solved) Harris Company Manufactures And Sells A Single Product Variable Costs Number Of Units Sold Variable costs = total cost of materials + total cost of labor. Total costs = fixed costs + variable costs. Variable cost per unit explained. Variable cost per unit refers to the incremental cost associated with producing one additional unit of a product or. Total variable cost = (total quantity of output) x (variable cost per unit of output) cost. Variable Costs Number Of Units Sold.

From www.chegg.com

Solved Intercontinental, Inc., provides you with the Variable Costs Number Of Units Sold That unit could be a. The formula can be represented in 2 ways: Variable cost per unit refers to the incremental cost associated with producing one additional unit of a product or. Variable costs = total cost of materials + total cost of labor. Variable cost per unit explained. Total costs = fixed costs + variable costs. Total variable cost. Variable Costs Number Of Units Sold.

From www.chegg.com

Solved Variable costs per unit Direct materials Direct Variable Costs Number Of Units Sold Variable costs = total cost of materials + total cost of labor. The formula for total variable cost is: Variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is. Total variable cost = (total quantity of output) x (variable cost per unit of output) cost of. A variable cost is the price. Variable Costs Number Of Units Sold.

From www.slideserve.com

PPT Chapter 2 PowerPoint Presentation, free download ID1130963 Variable Costs Number Of Units Sold Alternatively, a company’s variable costs can also be. That unit could be a. Total variable cost = (total quantity of output) x (variable cost per unit of output) cost of. A variable cost is an expense that changes in proportion to production output or sales. Variable costing is a concept used in managerial and cost accounting in which the fixed. Variable Costs Number Of Units Sold.

From www.chegg.com

Solved Exercise 69 Variable and Absorption Costing Unit Variable Costs Number Of Units Sold Variable costs = total cost of materials + total cost of labor. The formula can be represented in 2 ways: Total costs = fixed costs + variable costs. The formula for total variable cost is: Total variable cost = (total quantity of output) x (variable cost per unit of output) cost of. Variable costing is a concept used in managerial. Variable Costs Number Of Units Sold.

From www.coursehero.com

[Solved] Under (1) Absorption costing and (2) Variable costing, provide Variable Costs Number Of Units Sold That unit could be a. The formula can be represented in 2 ways: A variable cost is an expense that changes in proportion to production output or sales. Variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is. The formula for total variable cost is: Variable cost per unit refers to the. Variable Costs Number Of Units Sold.

From www.chegg.com

Solved Required a. Compute the unit product cost under both Variable Costs Number Of Units Sold Total costs = fixed costs + variable costs. The formula for total variable cost is: The formula can be represented in 2 ways: A variable cost is the price of raw materials, labor, and distribution associated with each unit of product or service you sell. Variable costing is a concept used in managerial and cost accounting in which the fixed. Variable Costs Number Of Units Sold.

From efinancemanagement.com

Variable Costs and Fixed Costs Variable Costs Number Of Units Sold When production or sales increase, variable costs increase; A variable cost is the price of raw materials, labor, and distribution associated with each unit of product or service you sell. A variable cost is an expense that changes in proportion to production output or sales. Variable costing is a concept used in managerial and cost accounting in which the fixed. Variable Costs Number Of Units Sold.

From www.chegg.com

Solved Lynch Company manufactures and sells a single Variable Costs Number Of Units Sold Variable cost per unit refers to the incremental cost associated with producing one additional unit of a product or. Total costs = fixed costs + variable costs. Variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is. Variable cost per unit explained. A variable cost is an expense that changes in proportion. Variable Costs Number Of Units Sold.